Get professional financial consulting from Hana Asset Trust.

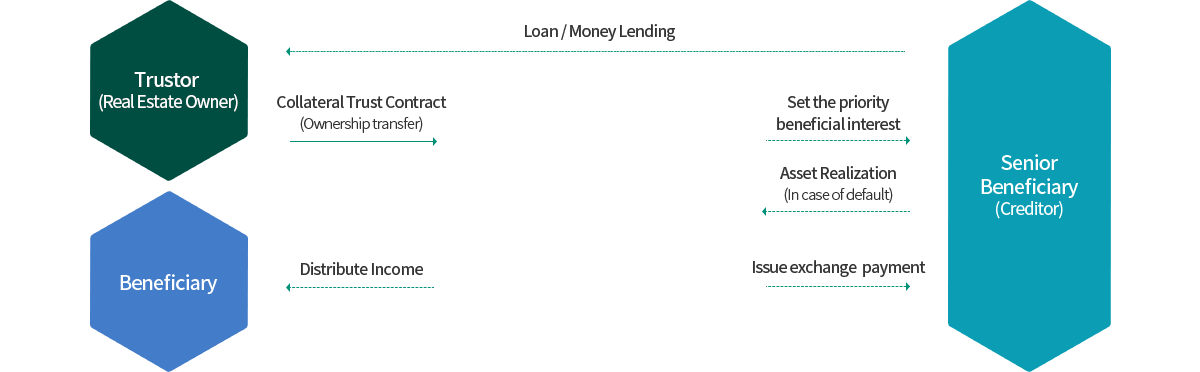

You can receive real estate-secured loans more conveniently.

Get professional financial consulting from Hana Asset Trust.

| Category | Real Estate Collateral Trust | Mortgage system |

|---|---|---|

| How to create Collateral | Transfer ownership to trust company | Create mortgage right |

| Property Rights Protection |

Prevent third party's infringement of rights after trust registration |

Seizure by third-party creditors allowed (posterior mortgage rights, real estate provisional seizure, etc.) |

| Additional Collaterals | Easy to add collaterals (simple parcel addition) | Complex (e.g., new mortgage creation contract) |

|

Compulsory Execution by Posterior Creditor |

Optional (subject to consent by senior creditor) |

Third-party creditors can apply for compulsory auction or posterior mortgagees can apply for voluntary auction |

| Realization (Into money) | Public sale by trust company (quick/simple/low cost) | Voluntary auction by court (slow/complex/high cost) |